Smart Tips About How To Find Out The Sales Tax

Counties may impose an additional one percent (1%).

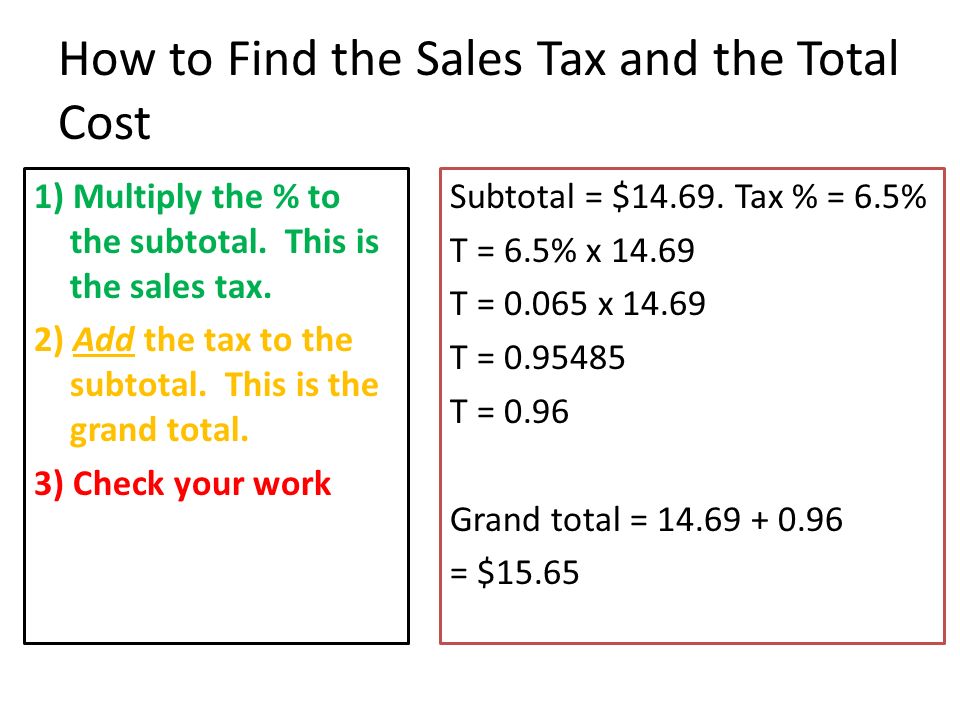

How to find out the sales tax. Tax rates are also available online at utah sales & use tax rates or you can. To calculate the sales tax that is included in a company's receipts, divide the total amount received (for the items that are subject to sales tax) by 1 + the sales tax rate. Sales tax is imposed on the sale of goods and certain services in south carolina.

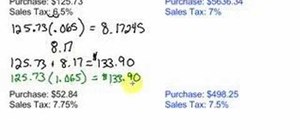

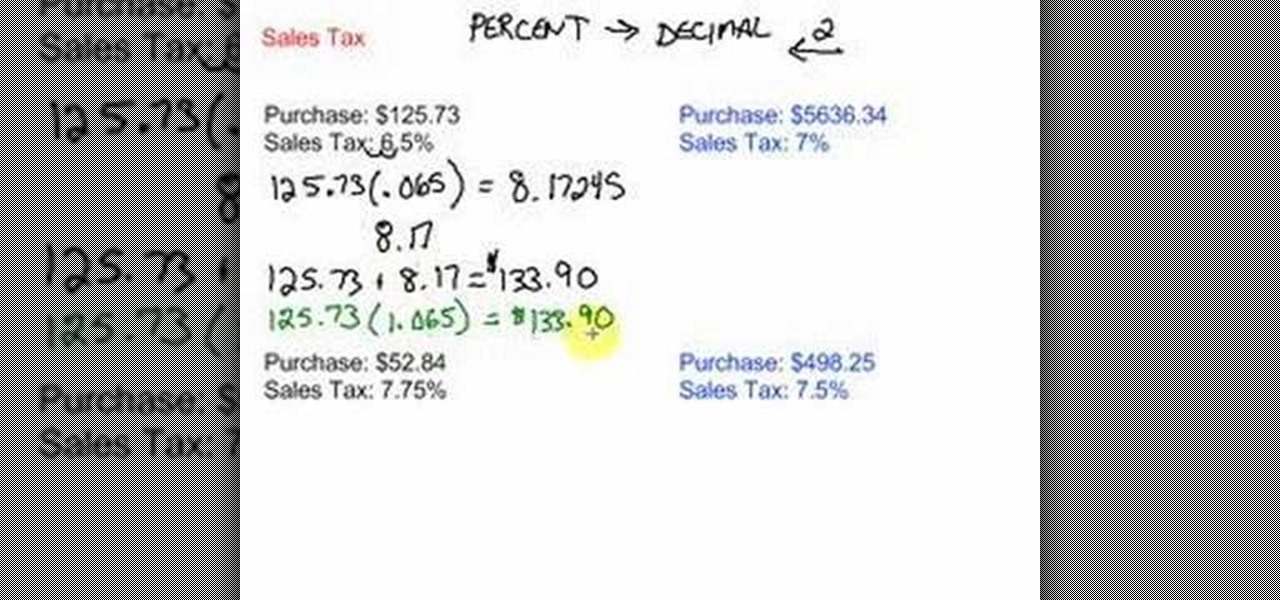

Use the map to find the general sales and use tax rate and locality code* for any location in virginia. Remember to convert the sales tax percentage to decimal format. For example, if your state sales tax rate is.

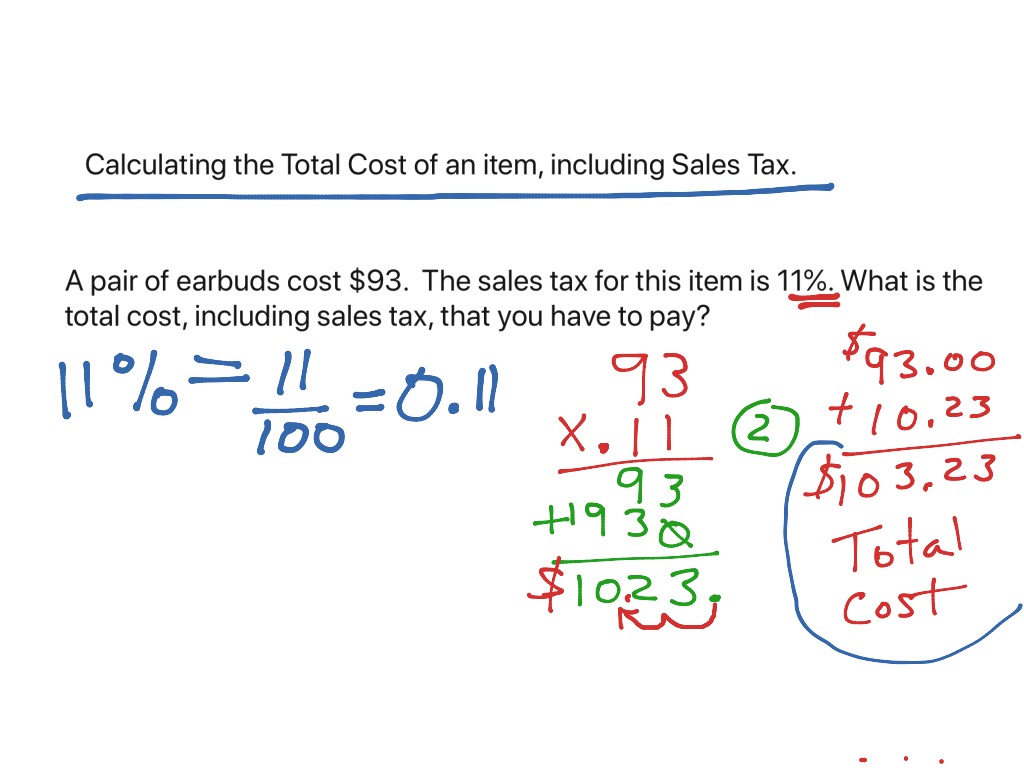

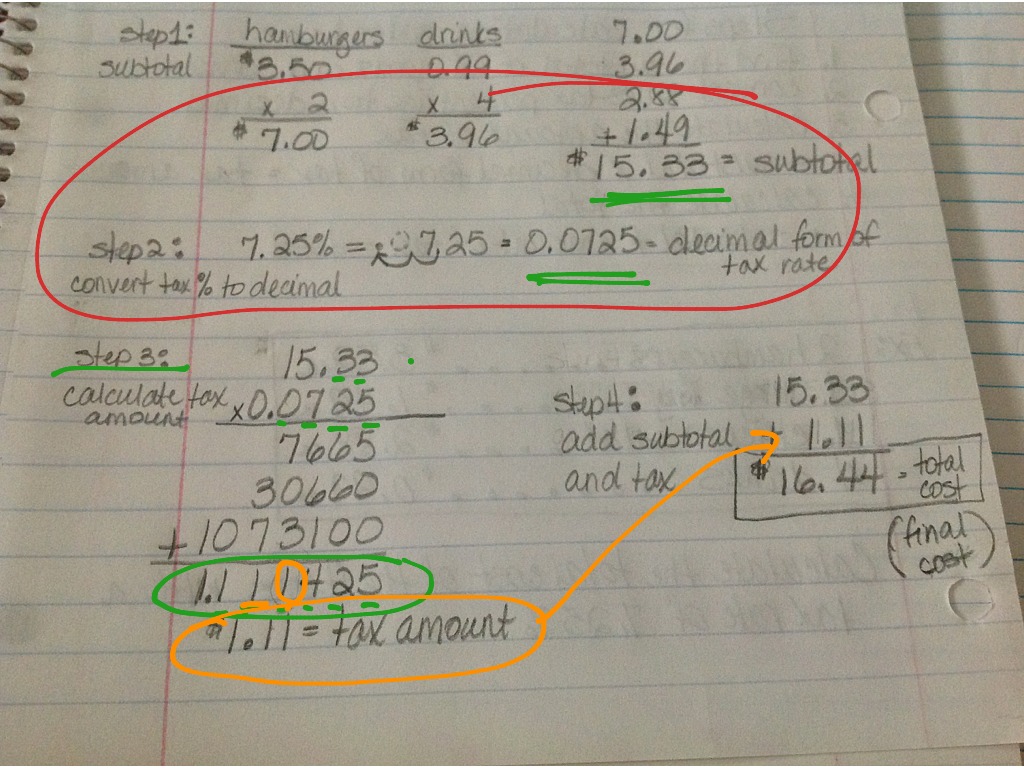

Divide your sales receipts by 1 plus the sales tax percentage. The statewide sales and use tax rate is six percent (6%). Step 1, figure your total sales, writing down the total price of the item or items.

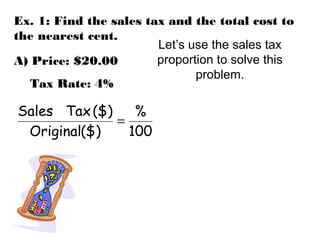

All you have to input is the amount of sales tax you paid and the final price on your receipt. If you knew you sold a $50 item, with $5.05 in sales tax, you would use this formula to figure out the sales tax percentage: 54 rows a sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Gail cole sep 19, 2022. City rates with local codes and total tax rates, county rates with local codes and effective date, transit rates with. Arlington is located within arlington county,.

If you are already registered with us, update your registration to. Businesses shipping goods into utah can look up their customer’s tax rate by address or zip code at tap.utah.gov. Use the sales tax rate locator to search for sales tax rates by address.